Should a SAAS startup capitalize or expense software development costs?

When launching a SaaS startup, one of the critical financial decisions revolves around how to account for software development costs: should they be capitalized or expensed? This choice can significantly impact a company’s financial statements, tax obligations, and overall business strategy. Capitalizing these costs spreads them over time, aligning expenses with the revenue they generate, while expensing them upfront can reduce taxable income in the short term. Understanding the implications of each approach is essential for founders, investors, and stakeholders aiming to optimize financial health and compliance. This article explores the key considerations, accounting standards, and strategic insights to help SaaS startups make informed decisions.

-

Should a SAAS Startup Capitalize or Expense Software Development Costs?

- What Does It Mean to Capitalize Software Development Costs?

- What Does It Mean to Expense Software Development Costs?

- When Should a SAAS Startup Capitalize Software Development Costs?

- What Are the Benefits of Capitalizing Software Development Costs?

- What Are the Risks of Capitalizing Software Development Costs?

- How Do Accounting Standards Influence the Decision to Capitalize or Expense?

- Is software development expensed or capitalized?

- Do SaaS companies capitalize R&D?

- Should development costs be capitalized or expensed?

- Does SaaS need to be capitalized?

-

Frequently Asked Questions (FAQ)

- What is the difference between capitalizing and expensing software development costs?

- When should a SAAS startup capitalize software development costs?

- What are the accounting standards for capitalizing software development costs?

- What are the implications of capitalizing vs. expensing software development costs?

Should a SAAS Startup Capitalize or Expense Software Development Costs?

When it comes to managing software development costs, SAAS startups face a critical decision: whether to capitalize or expense these costs. This decision can significantly impact the company's financial statements, tax obligations, and overall financial health. Understanding the difference between capitalizing and expensing, as well as the implications of each, is essential for making an informed choice.

What Does It Mean to Capitalize Software Development Costs?

Capitalizing software development costs involves recording these expenses as an asset on the balance sheet rather than as an immediate expense on the income statement. This approach is typically used when the software is expected to provide long-term benefits to the company. By capitalizing, the costs are amortized over the useful life of the software, spreading the expense over several years.

| Term | Definition |

|---|---|

| Capitalization | Recording costs as an asset to be amortized over time. |

| Amortization | Gradually expensing the capitalized costs over the asset's useful life. |

What Does It Mean to Expense Software Development Costs?

Expensing software development costs means recording them as an immediate expense on the income statement. This approach is typically used when the software development does not meet the criteria for capitalization, such as when the costs are incurred during the research and development (R&D) phase. Expensing these costs reduces the company's taxable income in the current period.

| Term | Definition |

|---|---|

| Expensing | Recording costs as an immediate expense on the income statement. |

| R&D Phase | The initial phase of software development where costs are typically expensed. |

When Should a SAAS Startup Capitalize Software Development Costs?

A SAAS startup should consider capitalizing software development costs when the software reaches the application development stage and is expected to generate future economic benefits. This stage typically follows the R&D phase and involves the creation of a marketable product. Capitalizing costs at this stage aligns with accounting standards and provides a more accurate representation of the company's financial position.

| Stage | Criteria for Capitalization |

|---|---|

| Application Development | Costs incurred after the R&D phase, when the software is expected to generate future benefits. |

What Are the Benefits of Capitalizing Software Development Costs?

Capitalizing software development costs offers several benefits, including smoothing out expenses over time, which can lead to more stable financial statements. It also allows the company to defer tax liabilities by spreading the costs over multiple years. Additionally, capitalizing costs can improve the company's balance sheet by increasing its asset base, which may be beneficial for attracting investors.

| Benefit | Description |

|---|---|

| Smoothing Expenses | Spreading costs over time for more stable financial statements. |

| Deferring Tax Liabilities | Reducing taxable income by amortizing costs over several years. |

What Are the Risks of Capitalizing Software Development Costs?

While capitalizing software development costs has its advantages, it also comes with risks. If the software fails to generate the expected future economic benefits, the company may need to write down or write off the capitalized costs, leading to a sudden and significant impact on the income statement. Additionally, capitalizing costs can complicate financial reporting and may attract scrutiny from auditors or regulators.

| Risk | Description |

|---|---|

| Write-Down/Write-Off | Reducing or eliminating the value of capitalized assets if they fail to generate expected benefits. |

| Regulatory Scrutiny | Increased attention from auditors or regulators due to complex financial reporting. |

How Do Accounting Standards Influence the Decision to Capitalize or Expense?

Accounting standards, such as GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards), provide guidelines on when software development costs should be capitalized or expensed. Under GAAP, costs incurred during the preliminary project stage and post-implementation stage are typically expensed, while costs during the application development stage may be capitalized. IFRS has similar guidelines but may differ in specific criteria.

| Standard | Guidelines |

|---|---|

| GAAP | Costs during preliminary and post-implementation stages are expensed; application development costs may be capitalized. |

| IFRS | Similar to GAAP but may have different criteria for capitalization. |

Is software development expensed or capitalized?

Understanding the Basics of Software Development Costs

When it comes to software development, costs can either be expensed or capitalized, depending on the stage of development. The key is to determine whether the costs are associated with the research phase or the development phase. Here’s a breakdown:

- Research Phase: Costs incurred during the research phase are typically expensed as they are considered exploratory and do not guarantee future economic benefits.

- Development Phase: Costs incurred during the development phase can be capitalized if the software meets specific criteria, such as being technically feasible and intended for sale or internal use.

- Post-Development: Costs related to maintenance, updates, or bug fixes after the software is operational are generally expensed as they do not extend the software’s useful life.

Criteria for Capitalizing Software Development Costs

To capitalize software development costs, certain conditions must be met. These conditions ensure that the costs are associated with creating a tangible asset. The criteria include:

- Technical Feasibility: The software must be proven to be technically feasible, meaning it can be developed and will function as intended.

- Intent to Use or Sell: The software must be intended for either internal use or sale to customers.

- Ability to Measure Costs: The costs associated with the development must be reliably measurable and directly attributable to the software project.

Expensing Software Development Costs

Not all software development costs can be capitalized. Some costs must be expensed immediately. These include:

- Research Costs: Costs incurred during the initial research phase, where the outcome is uncertain, are expensed.

- Training Costs: Costs related to training employees on how to use the software are expensed.

- Maintenance Costs: Ongoing maintenance and support costs after the software is operational are expensed.

Impact on Financial Statements

The decision to expense or capitalize software development costs has a significant impact on a company’s financial statements. Here’s how:

- Expensed Costs: Expensed costs are recorded on the income statement, reducing net income in the period they are incurred.

- Capitalized Costs: Capitalized costs are recorded as an asset on the balance sheet and amortized over the software’s useful life, affecting both the balance sheet and income statement over time.

- Cash Flow: Both expensed and capitalized costs impact cash flow, but the timing of the impact differs.

Regulatory and Accounting Standards

Accounting for software development costs is governed by specific regulatory and accounting standards. These standards provide guidelines on when to expense or capitalize costs:

- GAAP: Under Generally Accepted Accounting Principles (GAAP), software development costs are capitalized once technological feasibility is established.

- IFRS: International Financial Reporting Standards (IFRS) also allow capitalization of development costs if certain criteria are met.

- Internal Use vs. Sale: Different rules may apply depending on whether the software is for internal use or intended for sale.

Do SaaS companies capitalize R&D?

What is R&D Capitalization in SaaS Companies?

R&D capitalization refers to the process of recording research and development expenses as an asset on the balance sheet rather than expensing them immediately. For SaaS companies, this involves determining whether the costs incurred during the development phase of software can be capitalized under accounting standards like GAAP or IFRS.

- GAAP allows capitalization of software development costs once technological feasibility is established.

- IFRS permits capitalization if certain criteria, such as the ability to generate future economic benefits, are met.

- Expenses before technological feasibility are typically expensed as incurred.

When Can SaaS Companies Capitalize R&D Costs?

SaaS companies can capitalize R&D costs only when specific conditions are met. These conditions ensure that the costs are directly tied to the development of a product with future economic benefits.

- Technological feasibility must be demonstrated, meaning the software can be produced to meet its design specifications.

- The project must have a high probability of completion and future revenue generation.

- Costs incurred after achieving technological feasibility but before the product launch can be capitalized.

What Costs Are Typically Capitalized in SaaS R&D?

Not all R&D costs are eligible for capitalization. SaaS companies must carefully identify which costs qualify under accounting standards.

- Direct labor costs for employees working on the software development.

- Materials and services used specifically for the development process.

- Overhead costs directly attributable to the development project.

How Does R&D Capitalization Impact Financial Statements?

Capitalizing R&D costs affects a SaaS company's financial statements by altering how expenses and assets are reported.

- Balance Sheet: Capitalized costs appear as an asset, increasing total assets.

- Income Statement: Instead of immediate expense recognition, costs are amortized over the asset's useful life, reducing short-term expenses.

- Cash Flow Statement: Capitalized costs are classified as investing activities rather than operating expenses.

What Are the Challenges of Capitalizing R&D in SaaS?

Capitalizing R&D costs presents several challenges for SaaS companies, particularly in compliance and judgment.

- Judgment Calls: Determining technological feasibility and future economic benefits requires significant judgment.

- Compliance Risks: Misclassifying expenses can lead to regulatory scrutiny and financial restatements.

- Amortization Complexity: Estimating the useful life of capitalized software can be complex and subjective.

Should development costs be capitalized or expensed?

Understanding Development Costs

Development costs refer to the expenses incurred during the creation or improvement of a product, service, or process. These costs can include research, design, testing, and other activities aimed at bringing an idea to fruition. The decision to capitalize or expense these costs depends on the nature of the development activities and the accounting standards being followed.

- Research Costs: Typically expensed as incurred because they are considered exploratory and do not guarantee future economic benefits.

- Development Costs: May be capitalized if they meet specific criteria, such as demonstrating technical feasibility and the intention to complete the project.

- Regulatory Requirements: Different accounting frameworks, like GAAP or IFRS, have distinct rules for capitalizing development costs.

Criteria for Capitalizing Development Costs

To capitalize development costs, certain conditions must be met. These conditions ensure that the costs are associated with a project that is likely to generate future economic benefits.

- Technical Feasibility: The project must be technically viable, meaning it is possible to complete the development and use or sell the resulting asset.

- Intention to Complete: The company must demonstrate a clear intention to finish the project and use or sell the asset.

- Ability to Measure Costs: The costs associated with the development must be reliably measurable and directly attributable to the project.

When to Expense Development Costs

Development costs are expensed when they do not meet the criteria for capitalization. This approach ensures that only costs with a clear link to future economic benefits are recorded as assets.

- Early-Stage Development: Costs incurred during the early stages of a project, where outcomes are uncertain, are typically expensed.

- Failed Projects: If a project is abandoned, all associated costs are expensed immediately.

- Ongoing Maintenance: Costs related to maintaining or updating an existing product are expensed as incurred.

Impact on Financial Statements

The decision to capitalize or expense development costs has significant implications for a company's financial statements.

- Balance Sheet: Capitalized costs appear as assets, increasing the company's total assets and potentially improving financial ratios.

- Income Statement: Expensed costs reduce net income in the period they are incurred, while capitalized costs are amortized over time, spreading the expense.

- Cash Flow: Capitalizing costs does not affect cash flow directly, but it can influence how cash flows are presented in the statement of cash flows.

Accounting Standards and Compliance

Different accounting standards provide specific guidelines on whether development costs should be capitalized or expensed.

- GAAP (Generally Accepted Accounting Principles): Under GAAP, development costs are generally expensed unless they meet strict criteria for capitalization.

- IFRS (International Financial Reporting Standards): IFRS allows for the capitalization of development costs if certain conditions are met, providing more flexibility compared to GAAP.

- Industry-Specific Guidelines: Some industries, such as software development, have additional rules for capitalizing development costs.

Does SaaS need to be capitalized?

What is SaaS and Why Capitalization Matters

Software as a Service (SaaS) refers to a cloud-based software delivery model where applications are hosted by a third-party provider and made available to customers over the internet. The question of whether SaaS needs to be capitalized often arises in writing, especially in formal or technical contexts. Capitalization rules depend on the context in which the term is used. Below are key considerations:

- Acronyms: SaaS is an acronym, and acronyms are typically capitalized in English.

- Proper Nouns: If SaaS is used as a proper noun, such as the name of a specific product or company, it should be capitalized.

- General Usage: In general writing, SaaS is capitalized to maintain consistency and clarity.

Grammatical Rules for Capitalizing SaaS

Understanding the grammatical rules for capitalizing SaaS is essential for proper usage. Here are the main guidelines:

- Acronyms and Initialisms: SaaS stands for Software as a Service, and acronyms are always capitalized in English.

- Sentence Position: If SaaS appears at the beginning of a sentence, it must be capitalized regardless of context.

- Industry Standards: In the tech industry, SaaS is consistently capitalized to align with professional writing standards.

When to Capitalize SaaS in Business Writing

In business and professional writing, the capitalization of SaaS is often dictated by style guides and industry norms. Consider the following:

- Formal Documents: In contracts, reports, or white papers, SaaS is capitalized to maintain professionalism.

- Marketing Materials: SaaS is capitalized in brochures, websites, and advertisements to ensure brand consistency.

- Technical Documentation: In user manuals or technical guides, SaaS is capitalized to align with industry standards.

Common Mistakes in Capitalizing SaaS

Many writers make errors when capitalizing SaaS. Here are some common mistakes to avoid:

- Lowercase Usage: Using saas instead of SaaS is incorrect, as it disregards the rules for acronyms.

- Inconsistent Capitalization: Switching between SaaS and saas within the same document creates confusion.

- Ignoring Context: Failing to capitalize SaaS in formal or technical writing can appear unprofessional.

Style Guides and SaaS Capitalization

Style guides provide specific rules for capitalizing SaaS. Here’s how major style guides address this:

- AP Style: The Associated Press (AP) Stylebook recommends capitalizing acronyms like SaaS.

- Chicago Manual of Style: This guide also supports capitalizing acronyms, including SaaS.

- MLA and APA: Both academic style guides require capitalization of acronyms like SaaS in formal writing.

Frequently Asked Questions (FAQ)

What is the difference between capitalizing and expensing software development costs?

When a SAAS startup develops software, it must decide whether to capitalize or expense the associated costs. Capitalizing means recording the costs as an asset on the balance sheet, which is then amortized over the useful life of the software. This approach is typically used for costs incurred during the application development stage, such as coding and testing. On the other hand, expensing involves recording the costs as an expense on the income statement in the period they are incurred. This is common for costs related to the research and planning stages of software development, as they do not directly contribute to the creation of a tangible asset.

When should a SAAS startup capitalize software development costs?

A SAAS startup should capitalize software development costs when the costs are directly attributable to the creation of a software product that will generate future economic benefits. This typically occurs during the application development stage, after the project has reached a point of technological feasibility. Costs incurred during this stage, such as coding, testing, and debugging, can be capitalized. However, costs related to preliminary project stages, such as market research or initial planning, should be expensed as they are incurred, as they do not meet the criteria for capitalization.

What are the accounting standards for capitalizing software development costs?

The accounting standards for capitalizing software development costs are primarily governed by GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards). Under GAAP, specifically ASC 985-20, costs incurred during the application development stage can be capitalized once technological feasibility is established. Similarly, IFRS under IAS 38 allows for the capitalization of development costs if certain criteria are met, such as the ability to demonstrate the technical feasibility of completing the software and the intention to use or sell it. It is crucial for SAAS startups to adhere to these standards to ensure compliance and accurate financial reporting.

What are the implications of capitalizing vs. expensing software development costs?

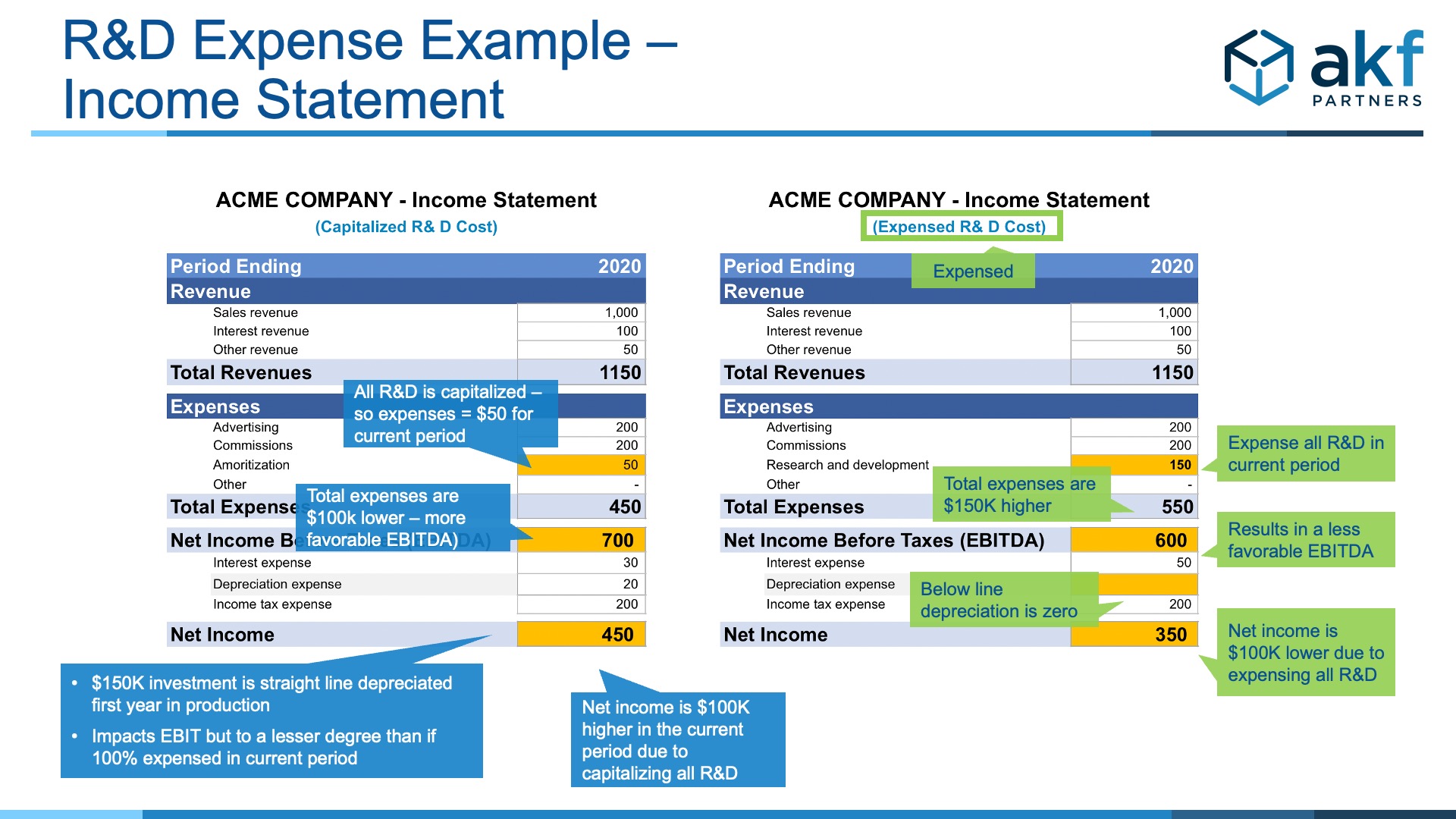

The decision to capitalize or expense software development costs has significant implications for a SAAS startup's financial statements. Capitalizing costs spreads the expense over the useful life of the software, which can improve short-term profitability by reducing expenses on the income statement. However, it also increases the company's asset base and may lead to higher amortization expenses in future periods. On the other hand, expensing costs immediately reduces current profitability but avoids future amortization expenses. This decision can also impact key financial metrics, such as EBITDA and net income, which are closely monitored by investors and stakeholders. Therefore, it is essential for SAAS startups to carefully consider the long-term financial and strategic implications of their accounting choices.

Deja una respuesta

Entradas Relacionadas