How should a chart of accounts be structured for a SaaS company?

A well-structured chart of accounts (COA) is essential for any SaaS company to effectively manage its financial operations and gain meaningful insights into its performance. Unlike traditional businesses, SaaS companies operate on subscription-based models, which require unique accounting practices to track recurring revenue, customer acquisition costs, and churn rates. A tailored COA ensures accurate financial reporting, simplifies compliance, and supports strategic decision-making. This article explores the key considerations for structuring a COA for a SaaS company, including revenue recognition, expense categorization, and the importance of aligning the COA with the company’s operational and reporting needs. By implementing a robust COA, SaaS businesses can streamline their financial processes and drive long-term growth.

How Should a Chart of Accounts Be Structured for a SaaS Company?

A well-structured chart of accounts (COA) is essential for any SaaS company to effectively manage its finances, track revenue, and ensure compliance with accounting standards. The COA serves as the backbone of a company's financial system, organizing transactions into categories that provide clarity and insight into the business's financial health. For SaaS companies, the COA must be tailored to reflect the unique aspects of the subscription-based business model, such as recurring revenue, deferred revenue, and customer acquisition costs.

1. Understanding the Basics of a Chart of Accounts

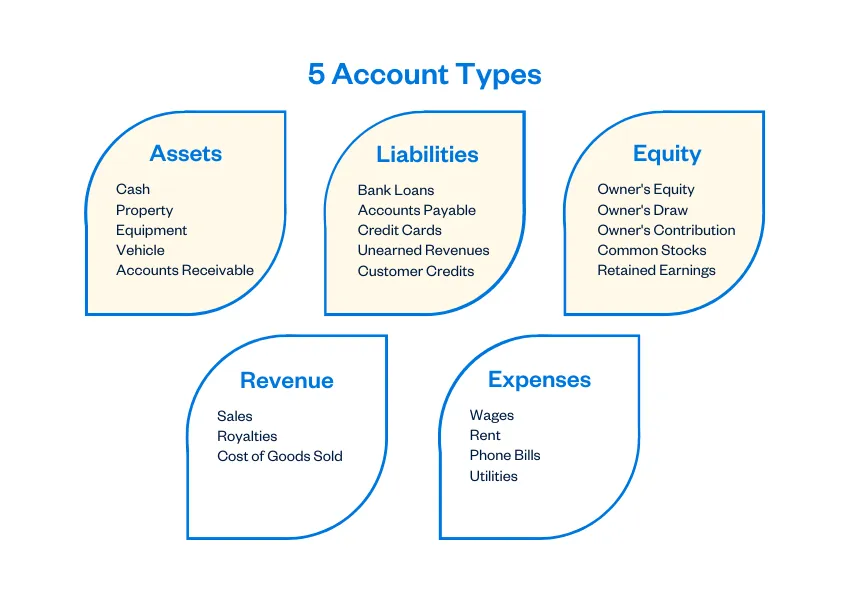

A chart of accounts is a structured list of all the financial accounts used by a business to record transactions. For a SaaS company, the COA should be designed to capture the nuances of the subscription model. This includes accounts for revenue recognition, deferred revenue, and customer-related expenses. The COA typically consists of five main categories: assets, liabilities, equity, revenue, and expenses. Each category should be further broken down into sub-accounts that provide detailed insights into the company's financial activities.

2. Key Revenue Accounts for SaaS Companies

Revenue recognition is a critical aspect of SaaS accounting. The COA should include accounts for monthly recurring revenue (MRR), annual recurring revenue (ARR), and one-time fees. Additionally, it should account for deferred revenue, which represents payments received in advance for services that will be delivered over time. Properly tracking these accounts ensures accurate financial reporting and compliance with accounting standards like ASC 606.

| Account Type | Description |

|---|---|

| MRR | Monthly Recurring Revenue from subscriptions |

| ARR | Annual Recurring Revenue from subscriptions |

| Deferred Revenue | Payments received for future services |

3. Managing Customer Acquisition Costs (CAC)

Customer Acquisition Costs (CAC) are a significant expense for SaaS companies. The COA should include accounts to track marketing and sales expenses, such as advertising costs, sales commissions, and customer onboarding expenses. By categorizing these costs separately, companies can calculate their CAC ratio and assess the efficiency of their sales and marketing efforts.

| Account Type | Description |

|---|---|

| Advertising Costs | Expenses related to online and offline ads |

| Sales Commissions | Payments to sales teams for closed deals |

| Onboarding Expenses | Costs associated with setting up new customers |

4. Tracking Operating Expenses

Operating expenses are a crucial part of the COA for SaaS companies. These include research and development (R&D), customer support, and general and administrative (G&A) expenses. R&D expenses are particularly important for SaaS companies, as they often invest heavily in product development. Separating these expenses allows for better budgeting and financial analysis.

| Account Type | Description |

|---|---|

| R&D | Costs related to product development |

| Customer Support | Expenses for maintaining customer service teams |

| G&A | General administrative and operational costs |

5. Incorporating Equity and Liability Accounts

Equity and liability accounts are essential for tracking the financial position of a SaaS company. Equity accounts include common stock, retained earnings, and additional paid-in capital. Liability accounts should cover accounts payable, accrued expenses, and deferred revenue. These accounts provide a clear picture of the company's financial obligations and ownership structure.

| Account Type | Description |

|---|---|

| Common Stock | Equity issued to shareholders |

| Retained Earnings | Accumulated profits reinvested in the business |

| Deferred Revenue | Liabilities for future service delivery |

How should a chart of accounts be structured?

Understanding the Purpose of a Chart of Accounts

A chart of accounts (COA) is a structured list of all financial accounts used by an organization. It serves as the foundation for organizing financial transactions and generating reports. To structure it effectively:

- Define the purpose: Ensure the COA aligns with the organization's financial reporting needs.

- Identify account categories: Group accounts into logical categories such as assets, liabilities, equity, revenue, and expenses.

- Ensure scalability: Design the COA to accommodate future growth or changes in the business.

Choosing the Right Account Categories

Selecting appropriate account categories is critical for a well-organized COA. These categories should reflect the organization's financial structure and reporting requirements.

- Assets: Include current and non-current assets like cash, inventory, and property.

- Liabilities: Cover short-term and long-term obligations such as loans and payables.

- Equity: Represent ownership interests, including retained earnings and common stock.

- Revenue: Track income sources like sales and service fees.

- Expenses: Categorize costs such as salaries, utilities, and supplies.

Numbering and Coding Accounts

Assigning unique numbers or codes to accounts ensures consistency and simplifies data entry and reporting.

- Use a logical numbering system: For example, assets could start with 1000, liabilities with 2000, and so on.

- Maintain uniformity: Ensure all accounts follow the same coding structure.

- Allow for expansion: Leave gaps in numbering to add new accounts as needed.

Aligning with Financial Reporting Standards

The COA must comply with applicable financial reporting standards, such as GAAP or IFRS, to ensure accuracy and consistency.

- Follow regulatory requirements: Ensure accounts meet legal and tax reporting obligations.

- Standardize account names: Use consistent terminology to avoid confusion.

- Support audit readiness: Design the COA to facilitate easy auditing and compliance checks.

Customizing for Business-Specific Needs

Tailor the COA to reflect the unique operations and financial structure of the organization.

- Incorporate industry-specific accounts: Add accounts relevant to the business sector, such as manufacturing or retail.

- Include departmental tracking: Use sub-accounts to monitor expenses or revenue by department.

- Adapt to organizational changes: Regularly review and update the COA to reflect new business activities or strategies.

What is the SaaS accounting method?

What is the SaaS Accounting Method?

The SaaS accounting method refers to the specialized approach used to manage and record financial transactions for Software as a Service (SaaS) businesses. Unlike traditional businesses, SaaS companies operate on subscription-based models, which require unique accounting practices to handle recurring revenue, deferred revenue, and customer acquisition costs. This method ensures accurate financial reporting and compliance with accounting standards like ASC 606 or IFRS 15, which govern revenue recognition for subscription-based services.

Key Components of SaaS Accounting

The SaaS accounting method involves several critical components that differentiate it from traditional accounting. These include:

- Recurring Revenue Tracking: SaaS businesses rely on subscription models, requiring accurate tracking of monthly or annual recurring revenue (MRR/ARR).

- Deferred Revenue Management: Revenue is recognized over the subscription period, not upfront, ensuring compliance with revenue recognition standards.

- Customer Acquisition Costs (CAC): Tracking and amortizing expenses related to acquiring new customers is essential for understanding profitability.

Revenue Recognition in SaaS Accounting

Revenue recognition is a cornerstone of SaaS accounting. Under ASC 606 and IFRS 15, revenue is recognized as the service is delivered, not when payment is received. This involves:

- Identifying Performance Obligations: Determining the specific services promised to the customer.

- Allocating Transaction Price: Distributing the total contract value across the subscription period.

- Recognizing Revenue Over Time: Recording revenue as the service is provided, ensuring accurate financial statements.

Challenges in SaaS Accounting

SaaS accounting presents unique challenges due to its subscription-based nature. These challenges include:

- Complex Revenue Recognition: Ensuring compliance with evolving accounting standards can be difficult.

- Handling Churn and Refunds: Managing cancellations and refunds requires precise adjustments to revenue and deferred revenue accounts.

- Scalability Issues: As the business grows, maintaining accurate financial records becomes increasingly complex.

Tools and Software for SaaS Accounting

To streamline SaaS accounting, businesses often use specialized tools and software. These tools help automate processes and ensure compliance. Key features include:

- Subscription Management: Automating billing and revenue tracking for recurring subscriptions.

- Revenue Recognition Automation: Ensuring compliance with ASC 606 and IFRS 15 standards.

- Financial Reporting: Generating detailed reports for MRR, ARR, CAC, and other critical SaaS metrics.

What are the 5 basic charts of accounts?

1. Assets

The Assets category in the chart of accounts includes all resources owned by a business that have economic value. These are typically divided into current and non-current assets. Examples include:

- Cash: Money in checking or savings accounts.

- Accounts Receivable: Amounts owed to the business by customers.

- Inventory: Goods available for sale.

- Prepaid Expenses: Payments made in advance for services or goods.

- Property, Plant, and Equipment (PP&E): Long-term tangible assets like buildings and machinery.

2. Liabilities

The Liabilities section records all obligations or debts that a business owes to external parties. These are also categorized as current or long-term liabilities. Key examples include:

- Accounts Payable: Amounts owed to suppliers or vendors.

- Loans Payable: Borrowed funds that need to be repaid.

- Accrued Expenses: Expenses incurred but not yet paid, like wages or taxes.

- Deferred Revenue: Payments received in advance for services not yet rendered.

- Mortgages: Long-term loans secured by property.

3. Equity

Equity represents the owner's claim on the business after all liabilities are subtracted from assets. It reflects the net worth of the business. Common components include:

- Owner's Capital: Initial and additional investments made by the owner.

- Retained Earnings: Profits reinvested in the business rather than distributed.

- Common Stock: Equity raised through the issuance of shares.

- Preferred Stock: Equity with priority over common stock in dividends.

- Treasury Stock: Shares repurchased by the company.

4. Revenue

The Revenue category tracks all income generated from the business's primary operations. It is crucial for assessing profitability. Examples include:

- Sales Revenue: Income from selling goods or services.

- Service Revenue: Income from providing services.

- Interest Income: Earnings from investments or loans.

- Rental Income: Revenue from leasing property or equipment.

- Other Operating Revenue: Miscellaneous income from business activities.

5. Expenses

Expenses represent the costs incurred to generate revenue. They are essential for calculating net income. Common examples include:

- Cost of Goods Sold (COGS): Direct costs of producing goods sold.

- Salaries and Wages: Payments to employees.

- Rent Expense: Costs for leasing property or equipment.

- Utilities: Expenses for electricity, water, and other utilities.

- Depreciation: Allocation of the cost of tangible assets over their useful life.

What is the appropriate order for a company's chart of accounts?

Understanding the Structure of a Chart of Accounts

A chart of accounts is a structured list of all the financial accounts used by a company. It is organized in a logical sequence to ensure clarity and ease of use. The appropriate order typically follows a standard hierarchy, starting with the most liquid assets and ending with equity and income/expense accounts. This structure helps in maintaining consistency and simplifies financial reporting.

- Assets: Listed first, starting with current assets like cash and accounts receivable, followed by fixed assets such as property and equipment.

- Liabilities: Includes current liabilities like accounts payable and long-term liabilities such as loans.

- Equity: Represents the owner's or shareholders' equity, including retained earnings and common stock.

- Revenue: Accounts for income generated from sales or services.

- Expenses: Categorizes costs incurred in running the business, such as salaries, utilities, and rent.

Importance of Logical Order in a Chart of Accounts

The logical order of a chart of accounts ensures that financial data is organized systematically, making it easier to locate and analyze specific accounts. This structure is crucial for accurate financial reporting and compliance with accounting standards.

- Ease of Access: A well-ordered chart allows quick access to specific accounts, reducing errors and saving time.

- Consistency: Standardized ordering ensures uniformity across financial statements and reports.

- Scalability: A logical structure accommodates growth, allowing new accounts to be added without disrupting the existing order.

Key Components of a Chart of Accounts

The chart of accounts is divided into five main components, each serving a specific purpose in financial management. These components are essential for tracking and managing a company's financial activities.

- Asset Accounts: Track resources owned by the company, such as cash, inventory, and equipment.

- Liability Accounts: Record obligations, including loans, accounts payable, and accrued expenses.

- Equity Accounts: Reflect the owner's or shareholders' stake in the company.

- Revenue Accounts: Capture income generated from business operations.

- Expense Accounts: Monitor costs associated with running the business.

Customizing a Chart of Accounts for Your Business

While the standard order of a chart of accounts provides a foundation, businesses often customize it to meet their specific needs. Tailoring the chart ensures it aligns with the company's operations and reporting requirements.

- Industry-Specific Accounts: Add accounts relevant to your industry, such as inventory for retail or project costs for construction.

- Departmental Breakdown: Create sub-accounts for different departments to track expenses and revenues separately.

- Regulatory Compliance: Ensure the chart adheres to local accounting standards and tax regulations.

Best Practices for Maintaining a Chart of Accounts

Maintaining an organized and up-to-date chart of accounts is essential for accurate financial management. Following best practices ensures the chart remains effective and reliable over time.

- Regular Reviews: Periodically review and update the chart to reflect changes in the business.

- Consistent Numbering: Use a consistent numbering system to categorize accounts logically.

- Training: Ensure staff are trained on how to use and update the chart correctly.

Frequently Asked Questions (FAQ)

What is the importance of structuring a chart of accounts for a SaaS company?

Structuring a chart of accounts for a SaaS company is crucial because it provides a clear and organized framework for tracking financial transactions. A well-structured chart of accounts ensures that revenue, expenses, assets, and liabilities are categorized accurately, which is essential for generating meaningful financial reports. For SaaS companies, this is particularly important due to the unique nature of their business model, which often includes recurring revenue, subscription-based income, and deferred revenue. A properly organized chart of accounts helps in monitoring key performance indicators (KPIs) such as monthly recurring revenue (MRR) and customer acquisition costs (CAC), enabling better decision-making and financial planning.

How should revenue accounts be organized in a SaaS chart of accounts?

In a SaaS company, revenue accounts should be organized to reflect the different types of revenue streams, such as subscription revenue, one-time setup fees, and professional services revenue. It is common to create separate accounts for each type of revenue to ensure clarity and accuracy in financial reporting. Additionally, SaaS companies often need to account for deferred revenue, which represents payments received in advance for services that will be delivered over time. This requires setting up liability accounts to track the unearned portion of revenue until it is recognized. Properly organizing revenue accounts helps in complying with revenue recognition standards like ASC 606 and provides a clear picture of the company's financial performance.

What expense categories should be included in a SaaS chart of accounts?

A SaaS company's chart of accounts should include detailed expense categories to accurately track costs associated with running the business. Common expense categories include cost of goods sold (COGS), which may include server costs, software licensing fees, and customer support expenses. Other important categories are research and development (R&D), marketing and sales expenses, general and administrative (G&A) expenses, and employee-related costs such as salaries and benefits. By categorizing expenses in this manner, SaaS companies can better understand their cost structure, identify areas for cost optimization, and ensure compliance with financial reporting requirements.

How can a SaaS company ensure scalability in its chart of accounts?

To ensure scalability in a SaaS company's chart of accounts, it is important to design a structure that can accommodate growth and changes in the business. This involves creating a flexible framework that allows for the addition of new accounts as the company expands its product offerings or enters new markets. For example, as the company grows, it may need to add more granular revenue accounts for different subscription tiers or geographic regions. Similarly, expense accounts should be designed to handle increased complexity, such as additional R&D projects or expanded marketing campaigns. Regularly reviewing and updating the chart of accounts ensures that it remains aligned with the company's evolving needs and supports accurate financial reporting as the business scales.

Deja una respuesta

Entradas Relacionadas