Compound Annual Growth Rate CAGR Formula and Calculator

The Compound Annual Growth Rate (CAGR) is a crucial metric used to evaluate investment performance and business growth. It represents the rate of return of an investment over a specified period, taking into account the compounding effect of growth from year to year. The CAGR formula provides a clear and concise way to calculate this growth rate, allowing investors and businesses to make informed decisions about their investments and strategies. By using a CAGR calculator, individuals can easily determine the growth rate of their investments and assess their overall performance over time. This facilitates data-driven decision making.

- Understanding Compound Annual Growth Rate (CAGR) Formula and Calculator

- How do you calculate compound annual growth rate CAGR?

- How to calculate CAGR on calculator?

- What does a 10% CAGR mean?

-

Frequently Asked Questions (FAQs)

- What is the Compound Annual Growth Rate (CAGR) and how is it calculated?

- How does the CAGR formula differ from other investment calculations, such as the arithmetic mean return?

- What are the limitations of the CAGR formula, and how can they be addressed?

- How can a CAGR calculator be used to evaluate investment opportunities and make informed decisions?

Understanding Compound Annual Growth Rate (CAGR) Formula and Calculator

The Compound Annual Growth Rate (CAGR) is a widely used metric to evaluate the performance of investments, businesses, and other financial metrics over a specified period. It represents the average annual growth rate of an investment or a company's profits over a certain period, typically more than one year. The CAGR formula is essential for investors, analysts, and entrepreneurs to assess the growth and potential of their investments or ventures.

What is Compound Annual Growth Rate (CAGR)?

The Compound Annual Growth Rate (CAGR) is a financial metric that calculates the average annual growth rate of an investment or a company's profits over a specified period. It takes into account the compounding effect of growth, providing a more accurate picture of the investment's performance. The CAGR metric is crucial for investors, as it helps them evaluate the potential of their investments and make informed decisions.

CAGR Formula and Calculation

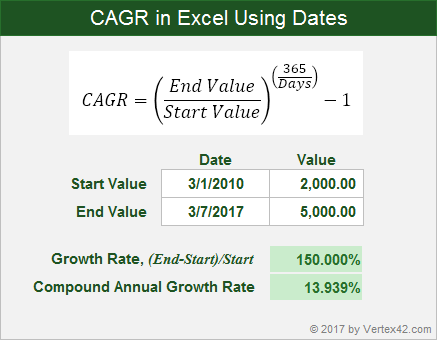

The CAGR formula is calculated using the following formula:

CAGR = (End Value / Beginning Value) ^ (1 / Number of Years) - 1. This formula requires the beginning value, end value, and the number of years to calculate the CAGR. The result is a percentage value that represents the average annual growth rate of the investment or company.

Importance of CAGR in Investment Analysis

The CAGR is an essential metric in investment analysis, as it helps investors evaluate the performance of their investments and make informed decisions. It provides a clear picture of the investment's growth potential and allows investors to compare the performance of different investments. The CAGR metric is also used to evaluate the performance of mutual funds, stocks, and other investment vehicles.

CAGR Calculator and Tools

A CAGR calculator is a tool used to calculate the Compound Annual Growth Rate of an investment or a company's profits. These calculators are available online and can be used to calculate the CAGR using the beginning value, end value, and number of years. The calculators provide a quick and accurate way to calculate the CAGR, making it easier for investors to evaluate the performance of their investments.

Limitations and Applications of CAGR

While the CAGR is a useful metric, it has its limitations. It does not take into account the volatility of the investment or the risk associated with it. The CAGR is also sensitive to the time period used in the calculation, and different time periods can result in different CAGR values. However, the CAGR remains a widely used metric in investment analysis and financial planning.

| Year | Beginning Value | End Value | CAGR |

|---|---|---|---|

| 1 | $100 | $120 | 20% |

| 2 | $120 | $150 | 25% |

| 3 | $150 | $200 | 33.33% |

The CAGR values in the table above represent the average annual growth rate of the investment over the specified period. The beginning value and end value are used to calculate the CAGR, which provides a clear picture of the investment's growth potential. The CAGR calculator can be used to calculate the CAGR for different investments and time periods, making it a valuable tool for investors and analysts.

How do you calculate compound annual growth rate CAGR?

To calculate the Compound Annual Growth Rate (CAGR), you need to know the initial and final values of an investment or a metric over a specified period. The CAGR is calculated using the formula: CAGR = (End Value / Beginning Value)^(1 / Number of Years) - 1. This formula takes into account the effect of compounding, where the growth rate is applied repeatedly over the specified period.

Understanding the CAGR Formula

The CAGR formula is a powerful tool for evaluating the performance of investments or metrics over time. To apply the formula, you need to have the following information:

- Initial value: The starting point of the investment or metric.

- Final value: The ending point of the investment or metric.

- Number of years: The time period over which the CAGR is being calculated.

The CAGR formula provides a smoothed rate of return, which can help to eliminate the impact of volatility and provide a more accurate picture of the investment's performance.

Applying the CAGR Formula

To apply the CAGR formula, you can use a calculator or a spreadsheet program like Microsoft Excel. The formula can be entered directly into the calculator or spreadsheet, using the initial and final values and the number of years. For example, if you want to calculate the CAGR of an investment that grew from $100 to $150 over 5 years, you would enter the values into the formula: CAGR = (150 / 100)^(1 / 5) - 1.

- Enter the initial value: $100.

- Enter the final value: $150.

- Enter the number of years: 5.

The result would be the CAGR, which can be expressed as a percentage.

Interpreting CAGR Results

The CAGR result can be interpreted in different ways, depending on the context. A high CAGR indicates a strong performance, while a low CAGR indicates a weaker performance. The CAGR can also be used to compare the performance of different investments or metrics.

- Comparing investments: CAGR can be used to compare the performance of different investments, such as stocks or mutual funds.

- Evaluating metrics: CAGR can be used to evaluate the performance of metrics, such as revenue or earnings growth.

- Setting expectations: CAGR can be used to set expectations for future growth, based on historical performance.

The CAGR result can provide valuable insights into the performance of investments or metrics.

CAGR vs. Average Annual Return

The CAGR is different from the average annual return, which is the simple average of the returns over a specified period. The CAGR takes into account the effect of compounding, while the average annual return does not.

- Average annual return: The simple average of the returns over a specified period.

- CAGR: The smoothed rate of return, which takes into account the effect of compounding.

- Key difference: The CAGR provides a more accurate picture of the investment's performance, while the average annual return can be misleading.

The CAGR is a more accurate measure of investment performance, as it takes into account the effect of compounding.

Limitations of CAGR

While the CAGR is a powerful tool for evaluating investment performance, it has some limitations. The CAGR assumes a constant growth rate, which may not always be the case. It also does not take into account the risk associated with the investment.

- Constant growth rate: The CAGR assumes a constant growth rate, which may not always be the case.

- Risk: The CAGR does not take into account the risk associated with the investment.

- Volatility: The CAGR can be affected by volatility, which can impact the accuracy of the result.

The CAGR should be used in conjunction with other metrics, such as the standard deviation, to get a more complete picture of the investment's performance.

How to calculate CAGR on calculator?

To calculate the Compound Annual Growth Rate (CAGR) on a calculator, you need to follow a series of steps. First, you need to know the initial value, the final value, and the number of years. Then, you can use the formula: CAGR = (Final Value / Initial Value)^(1/Number of Years) - 1. This formula will give you the CAGR as a decimal, which you can then convert to a percentage by multiplying by 100.

Understanding CAGR Formula

The CAGR formula is a powerful tool for calculating the growth rate of an investment over a period of time. To use the formula, you need to have the initial value, the final value, and the number of years. The formula is: CAGR = (Final Value / Initial Value)^(1/Number of Years) - 1. Here are the steps to follow:

- Identify the initial value and the final value of the investment.

- Determine the number of years the investment was held for.

- Plug the values into the CAGR formula and calculate the result.

Using a Financial Calculator

A financial calculator can make it easy to calculate the CAGR. To use a financial calculator, you need to enter the initial value, the final value, and the number of years. Then, you can use the calculator's built-in CAGR function to calculate the result. Here are the steps to follow:

- Enter the initial value into the calculator.

- Enter the final value into the calculator.

- Enter the number of years into the calculator and use the CAGR function to calculate the result.

Calculating CAGR with Multiple Investments

When calculating the CAGR for multiple investments, you need to use a weighted average of the individual CAGR values. To do this, you need to calculate the CAGR for each investment separately, then use the weighted average formula to combine the results. Here are the steps to follow:

- Calculate the CAGR for each investment separately using the CAGR formula.

- Assign a weight to each investment based on its relative size.

- Use the weighted average formula to combine the individual CAGR values into a single CAGR value.

Interpreting CAGR Results

The CAGR result can be used to evaluate the performance of an investment over time. A high CAGR indicates that the investment has grown rapidly, while a low CAGR indicates that the investment has grown slowly. Here are some things to consider when interpreting CAGR results:

- The CAGR result should be compared to the benchmark or industry average to determine if the investment has performed well.

- The CAGR result should be considered in conjunction with other investment metrics, such as return on investment (ROI) and risk.

- The CAGR result can be used to make investment decisions, such as deciding whether to buy or sell an investment.

Common CAGR Mistakes to Avoid

There are several common mistakes to avoid when calculating the CAGR. One of the most common mistakes is not accounting for compounding, which can result in an inaccurate CAGR value. Here are some other mistakes to avoid:

- Not using the correct formula, which can result in an inaccurate CAGR value.

- Not accounting for fees and expenses, which can reduce the CAGR value.

- Not considering the time value of money, which can affect the CAGR value.

What does a 10% CAGR mean?

:max_bytes(150000):strip_icc()/CAGR_final-67bb17a264264824b7a3ef6b121b89b9.png)

A 10% Compound Annual Growth Rate (CAGR) means that an investment or a company's revenue is increasing by 10% each year, compounded annually. This implies that the growth rate is consistent and sustained over a period of time. To understand the impact of a 10% CAGR, consider an investment of $100 that grows at a 10% CAGR for 5 years. At the end of 5 years, the investment would be worth approximately $161.05, assuming compounding occurs annually.

Understanding CAGR and its Implications

A 10% CAGR has significant implications for investments and businesses. It means that the return on investment is substantial and consistent, making it an attractive option for investors. To achieve a 10% CAGR, a company or investment must demonstrate strong financial performance and sustainable growth. Some key factors that contribute to a 10% CAGR include:

- Revenue growth: A company must experience consistent revenue growth to achieve a 10% CAGR.

- Expanding market share: Increasing market share can contribute to a 10% CAGR by driving revenue growth.

- Operational efficiency: A company must maintain operational efficiency to sustain a 10% CAGR and ensure that growth is profitable.

CAGR and Investment Returns

A 10% CAGR can result in substantial investment returns over time. For example, an investment of $1,000 that grows at a 10% CAGR for 10 years would be worth approximately $2,593.74, assuming annual compounding. To achieve a 10% CAGR, investors should consider the following:

- Long-term approach: A 10% CAGR requires a long-term investment approach, as short-term fluctuations can be volatile.

- Diversified portfolio: A diversified portfolio can help reduce risk and increase the potential for achieving a 10% CAGR.

- Risk management: Investors must be aware of potential risks and have a risk management strategy in place to mitigate them.

CAGR and Business Growth

A 10% CAGR is a challenging but achievable goal for businesses. To achieve a 10% CAGR, companies must focus on innovation, market expansion, and operational efficiency. Some key strategies for achieving a 10% CAGR include:

- Developing new products: Innovative products can drive revenue growth and contribute to a 10% CAGR.

- Expanding into new markets: Market expansion can increase revenue and help achieve a 10% CAGR.

- Improving operational efficiency: Operational efficiency is crucial for sustaining a 10% CAGR and ensuring that growth is profitable.

CAGR and Financial Performance

A 10% CAGR requires strong financial performance and sustainable growth. Companies that achieve a 10% CAGR must demonstrate consistent revenue growth, expanding market share, and operational efficiency. To evaluate a company's potential for achieving a 10% CAGR, consider the following:

- Revenue growth rate: A company's revenue growth rate is a key indicator of its potential for achieving a 10% CAGR.

- Financial leverage: Financial leverage can be used to amplify returns, but it also increases risk.

- Cash flow management: Effective cash flow management is essential for sustaining a 10% CAGR and ensuring that growth is profitable.

CAGR and Market Trends

A 10% CAGR can be influenced by market trends and economic conditions. Companies that achieve a 10% CAGR must be aware of market trends and adjust their strategies accordingly. Some key market trends that can impact a company's ability to achieve a 10% CAGR include:

- Technological advancements: Technological advancements can drive innovation and contribute to a 10% CAGR.

- Changing consumer behavior: Changing consumer behavior can create new opportunities for growth and help companies achieve a 10% CAGR.

- Globalization: Globalization can increase competition but also create new markets and opportunities for growth.

Frequently Asked Questions (FAQs)

What is the Compound Annual Growth Rate (CAGR) and how is it calculated?

The Compound Annual Growth Rate (CAGR) is a financial metric that calculates the rate of return of an investment over the course of a year, taking into account the compounding effect of interest. The CAGR formula is used to determine the average annual growth rate of an investment over a specified period of time. To calculate the CAGR, the following formula is used: CAGR = (End Value / Beginning Value)^(1 / Number of Years) - 1. This formula takes into account the initial investment, the final value of the investment, and the number of years the investment was held. The CAGR is then expressed as a percentage, which represents the average annual return on the investment.

How does the CAGR formula differ from other investment calculations, such as the arithmetic mean return?

The CAGR formula differs from other investment calculations, such as the arithmetic mean return, in that it takes into account the compounding effect of interest. The arithmetic mean return simply calculates the average return of an investment over a specified period of time, without considering the compounding effect. The CAGR formula, on the other hand, provides a more accurate representation of the investment's performance, as it accounts for the exponential growth of the investment over time. This makes the CAGR a more reliable metric for evaluating the performance of an investment, particularly over longer periods of time. Additionally, the CAGR formula can be used to compare the performance of different investments, making it a useful tool for investors and financial analysts.

What are the limitations of the CAGR formula, and how can they be addressed?

While the CAGR formula is a useful tool for evaluating the performance of an investment, it does have some limitations. One limitation is that it assumes a constant growth rate over the specified period of time, which may not always be the case. Additionally, the CAGR formula does not take into account volatility or risk, which can have a significant impact on the investment's performance. To address these limitations, investors and financial analysts can use other metrics, such as the standard deviation or the Sharpe ratio, to provide a more complete picture of the investment's performance. Furthermore, the CAGR formula can be used in conjunction with other analytical tools, such as financial modeling or sensitivity analysis, to provide a more accurate representation of the investment's potential performance.

How can a CAGR calculator be used to evaluate investment opportunities and make informed decisions?

A CAGR calculator can be a valuable tool for evaluating investment opportunities and making informed decisions. By using a CAGR calculator, investors and financial analysts can quickly and easily calculate the average annual return on an investment, and compare it to other investment opportunities. This can help to identify potential investment opportunities that may offer higher returns, and to evaluate the performance of existing investments. Additionally, a CAGR calculator can be used to stress test investment scenarios, and to evaluate the potential impact of different market conditions on the investment's performance. By using a CAGR calculator in conjunction with other analytical tools, investors and financial analysts can make more informed decisions about their investments, and to optimize their investment portfolios for maximum returns.

Deja una respuesta

Entradas Relacionadas