How is SaaS growing in the banking sector?

The banking sector is undergoing a significant transformation, driven by the rapid adoption of Software-as-a-Service (SaaS) solutions. As financial institutions strive to enhance operational efficiency, improve customer experiences, and meet evolving regulatory requirements, SaaS has emerged as a key enabler of innovation. Offering scalability, cost-effectiveness, and flexibility, SaaS platforms are empowering banks to modernize legacy systems, streamline processes, and deliver personalized services. From cloud-based core banking systems to AI-driven analytics tools, SaaS is reshaping how banks operate in an increasingly digital world. This article explores the growing influence of SaaS in the banking sector and its implications for the future of financial services.

How is SaaS Transforming the Banking Sector?

The banking sector is increasingly adopting Software as a Service (SaaS) solutions to streamline operations, enhance customer experiences, and reduce costs. SaaS offers banks the flexibility to scale their services, improve data security, and stay competitive in a rapidly evolving digital landscape. Below, we explore the key ways SaaS is growing in the banking industry.

1. Enhanced Scalability and Flexibility

SaaS platforms provide banks with the ability to scale their operations seamlessly. Unlike traditional software, SaaS solutions can be easily adjusted to meet changing demands, whether it's handling increased transaction volumes or expanding into new markets. This flexibility allows banks to respond quickly to market trends and customer needs.

| Benefit | Description |

|---|---|

| Scalability | Easily adjust resources based on demand. |

| Flexibility | Adapt to new market conditions and customer requirements. |

2. Cost-Effective Solutions

Banks are leveraging SaaS to reduce operational costs. By eliminating the need for on-premise infrastructure and maintenance, SaaS allows financial institutions to allocate resources more efficiently. This cost-effectiveness is particularly beneficial for smaller banks and credit unions looking to compete with larger players.

| Benefit | Description |

|---|---|

| Reduced Infrastructure Costs | No need for expensive hardware or software installations. |

| Lower Maintenance Expenses | Vendors handle updates and system maintenance. |

3. Improved Customer Experience

SaaS enables banks to offer personalized and efficient services to their customers. With advanced analytics and AI-driven tools, financial institutions can provide tailored recommendations, faster loan approvals, and seamless digital banking experiences. This focus on customer-centricity is driving higher satisfaction and loyalty.

| Benefit | Description |

|---|---|

| Personalization | Use data analytics to offer customized services. |

| Faster Service Delivery | Streamline processes like loan approvals and account openings. |

4. Enhanced Security and Compliance

Security is a top priority for banks, and SaaS providers are investing heavily in advanced security measures. From encryption to multi-factor authentication, SaaS platforms ensure that sensitive customer data is protected. Additionally, these solutions help banks stay compliant with regulatory requirements, reducing the risk of penalties.

| Benefit | Description |

|---|---|

| Data Encryption | Protect sensitive information from unauthorized access. |

| Regulatory Compliance | Ensure adherence to industry standards and regulations. |

5. Accelerated Innovation

SaaS allows banks to adopt cutting-edge technologies like AI, machine learning, and blockchain without significant upfront investments. This innovation enables financial institutions to stay ahead of the curve, offering new products and services that meet evolving customer expectations.

| Benefit | Description |

|---|---|

| Access to Advanced Technologies | Integrate AI, machine learning, and blockchain seamlessly. |

| Faster Time-to-Market | Launch new products and services quickly. |

How is SaaS used in banking?

Streamlining Customer Relationship Management (CRM)

SaaS platforms in banking are widely used to enhance customer relationship management. These tools allow banks to centralize customer data, track interactions, and provide personalized services. Key benefits include:

- Centralized data storage: All customer information is stored in one place, making it easily accessible for analysis and decision-making.

- Automated workflows: Routine tasks such as follow-ups and reminders are automated, improving efficiency.

- Enhanced customer insights: Advanced analytics help banks understand customer behavior and preferences, enabling tailored services.

Improving Loan and Credit Management

SaaS solutions are transforming how banks manage loans and credit. These platforms streamline the entire process, from application to approval and repayment. Key features include:

- Automated credit scoring: Algorithms assess creditworthiness quickly and accurately, reducing manual effort.

- Real-time monitoring: Banks can track loan performance and identify risks in real-time.

- Customizable repayment plans: SaaS tools allow banks to offer flexible repayment options based on customer profiles.

Enhancing Fraud Detection and Security

Banks leverage SaaS to strengthen fraud detection and security measures. These platforms use advanced technologies to identify and prevent fraudulent activities. Key advantages include:

- Real-time alerts: Instant notifications for suspicious transactions help banks act swiftly.

- Machine learning algorithms: These analyze patterns to detect anomalies and potential threats.

- Data encryption: Sensitive information is protected through robust encryption methods.

Facilitating Regulatory Compliance

SaaS tools play a critical role in helping banks meet regulatory requirements. These platforms simplify compliance by automating reporting and monitoring processes. Key functionalities include:

- Automated reporting: Generate compliance reports quickly and accurately.

- Audit trails: Maintain detailed records of all transactions and activities for regulatory scrutiny.

- Policy updates: Ensure compliance with the latest regulations through automatic updates.

Optimizing Digital Banking Services

SaaS is integral to the development and delivery of digital banking services. These platforms enable banks to offer seamless online and mobile banking experiences. Key benefits include:

- User-friendly interfaces: Intuitive designs enhance customer experience across devices.

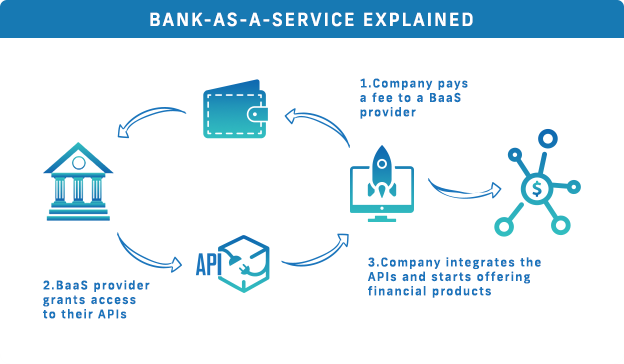

- Integration with third-party apps: Customers can access a wide range of financial services through APIs.

- Scalability: SaaS platforms can easily scale to accommodate growing customer demands.

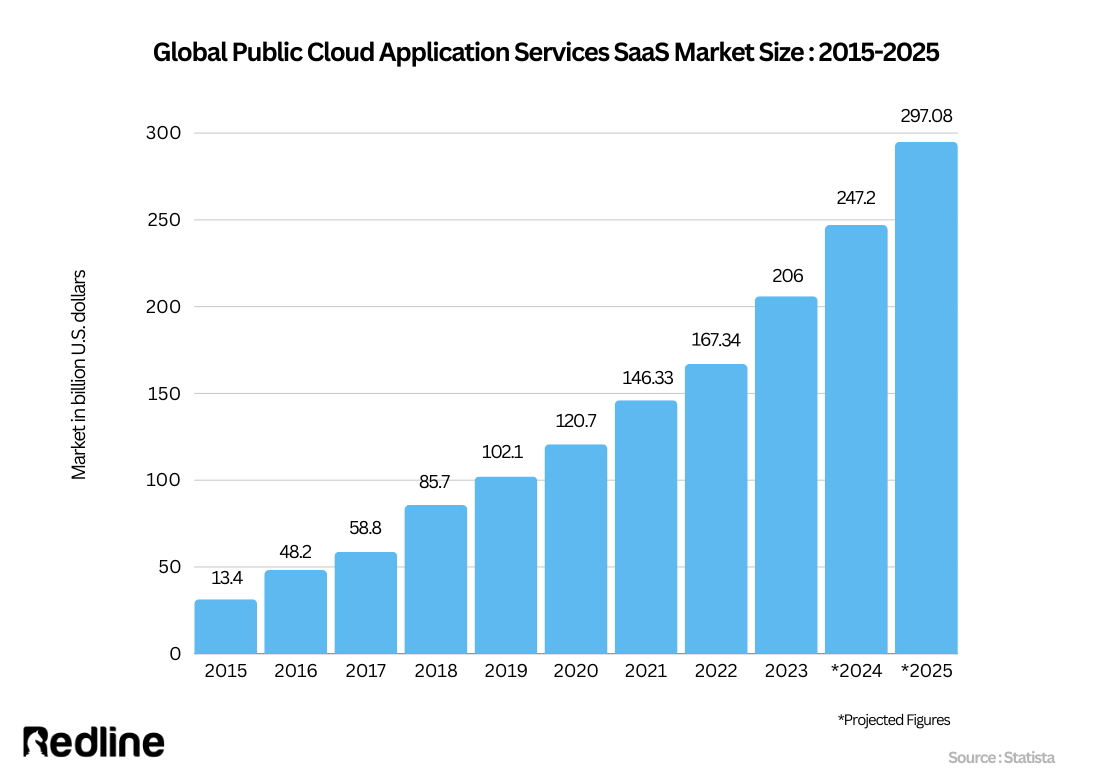

Is the SaaS industry growing?

What is Driving the Growth of the SaaS Industry?

The SaaS industry is experiencing significant growth due to several key factors:

- Cost Efficiency: SaaS solutions eliminate the need for expensive hardware and maintenance, making them more affordable for businesses.

- Scalability: Companies can easily scale their operations up or down based on demand without significant upfront investments.

- Remote Work Trends: The rise of remote work has increased the demand for cloud-based tools that facilitate collaboration and productivity.

How is the SaaS Market Expanding Globally?

The global SaaS market is expanding rapidly, driven by:

- Increased Internet Penetration: More businesses worldwide have access to reliable internet, enabling them to adopt SaaS solutions.

- Emerging Markets: Developing countries are adopting SaaS at a faster rate as digital transformation becomes a priority.

- Cross-Industry Adoption: Industries like healthcare, education, and finance are increasingly leveraging SaaS for operational efficiency.

What Role Does Innovation Play in SaaS Growth?

Innovation is a cornerstone of the SaaS industry's growth:

- AI and Machine Learning: SaaS platforms are integrating advanced technologies to offer smarter, more personalized solutions.

- Automation: Tools that automate repetitive tasks are becoming more prevalent, saving time and resources for businesses.

- User Experience: Continuous improvements in UX design are making SaaS products more intuitive and user-friendly.

How Are Investors Responding to the SaaS Boom?

Investors are showing strong interest in the SaaS sector:

- Venture Capital Funding: SaaS startups are attracting significant investments due to their high growth potential.

- Mergers and Acquisitions: Larger tech companies are acquiring SaaS firms to expand their product portfolios.

- IPO Activity: Many SaaS companies are going public, reflecting confidence in their long-term profitability.

What Challenges Could Impact SaaS Industry Growth?

Despite its growth, the SaaS industry faces several challenges:

- Data Security Concerns: As more data moves to the cloud, ensuring its security remains a top priority.

- Market Saturation: The increasing number of SaaS providers is leading to intense competition.

- Regulatory Compliance: Adhering to varying regulations across regions can be complex and costly for SaaS companies.

Which software is mostly used at banks?

Core Banking Systems

Core banking systems are the backbone of banking operations, enabling banks to manage customer accounts, transactions, and other essential services. The most widely used core banking software includes:

- Finacle by Infosys: Known for its scalability and flexibility, it supports retail, corporate, and wealth management.

- Flexcube by Oracle: A comprehensive solution for universal banking, offering multi-currency and multi-entity support.

- Temenos T24: A cloud-ready platform that provides real-time processing and advanced analytics.

Customer Relationship Management (CRM) Software

CRM software helps banks manage customer interactions, improve service, and enhance customer retention. Popular CRM tools in banking include:

- Salesforce Financial Services Cloud: Tailored for financial institutions, it offers tools for customer engagement and compliance.

- Microsoft Dynamics 365: Provides AI-driven insights and integrates seamlessly with other Microsoft products.

- SAP CRM: Known for its robust analytics and integration with SAP's ERP systems.

Risk Management and Compliance Software

Banks rely on specialized software to manage risks and ensure compliance with regulatory requirements. Key solutions include:

- SAS Risk Management: Offers advanced analytics for credit, market, and operational risk.

- IBM OpenPages: A governance, risk, and compliance (GRC) platform that helps banks meet regulatory standards.

- Moody’s Analytics: Provides tools for credit risk assessment and stress testing.

Payment Processing Software

Payment processing software is critical for handling transactions efficiently and securely. Widely used systems include:

- ACI Worldwide: Known for its real-time payment processing capabilities.

- Fiserv: Offers solutions for card payments, digital wallets, and merchant services.

- PayPal Braintree: A popular choice for online and mobile payment processing.

Data Analytics and Business Intelligence Tools

Banks use data analytics and BI tools to gain insights, improve decision-making, and enhance customer experiences. Leading tools include:

- Tableau: Enables banks to visualize data and create interactive dashboards.

- Power BI by Microsoft: Integrates with other Microsoft tools and offers advanced analytics features.

- QlikView: Known for its associative data modeling and real-time analytics capabilities.

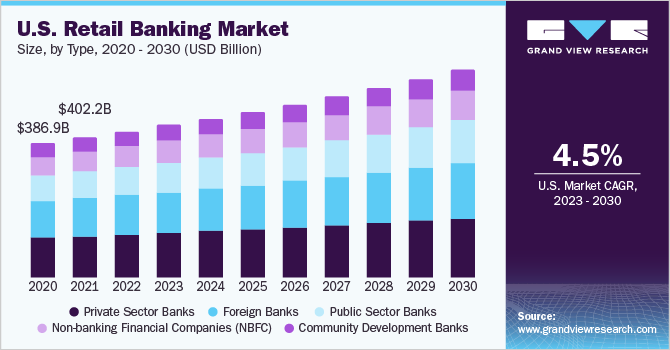

Is the banking industry growing?

Is the Banking Industry Growing Globally?

The banking industry is experiencing growth on a global scale, driven by several factors.

- Digital transformation has revolutionized banking services, making them more accessible and efficient.

- Emerging markets are contributing significantly to the expansion, with increasing financial inclusion.

- Technological advancements such as AI and blockchain are enhancing operational capabilities and customer experiences.

What Role Does Technology Play in the Growth of Banking?

Technology is a key driver in the growth of the banking sector.

- Mobile banking has made financial services more accessible to a broader audience.

- Artificial Intelligence is being used for personalized customer service and fraud detection.

- Blockchain technology is improving security and transparency in transactions.

How Are Emerging Markets Influencing Banking Growth?

Emerging markets are playing a pivotal role in the growth of the banking industry.

- Increased financial inclusion initiatives are bringing more people into the formal banking system.

- Rapid urbanization is driving demand for banking services in these regions.

- Government policies aimed at economic development are fostering a conducive environment for banking growth.

What Are the Challenges Facing the Growing Banking Industry?

Despite its growth, the banking industry faces several challenges.

- Regulatory compliance is becoming increasingly complex and costly.

- Cybersecurity threats are on the rise, requiring significant investment in security measures.

- Economic instability in certain regions can impact the overall growth trajectory.

How Is Consumer Behavior Shaping the Future of Banking?

Consumer behavior is significantly influencing the future of banking.

- Demand for convenience is pushing banks to adopt more user-friendly digital platforms.

- Preference for personalized services is driving the use of data analytics and AI.

- Increased awareness of financial products is leading to higher expectations from banking services.

Frequently Asked Questions (FAQ)

What is driving the growth of SaaS in the banking sector?

The growth of SaaS (Software as a Service) in the banking sector is primarily driven by the need for cost efficiency, scalability, and digital transformation. Banks are increasingly adopting SaaS solutions to reduce the high costs associated with maintaining on-premise infrastructure. Additionally, SaaS platforms offer flexibility and the ability to scale operations quickly, which is crucial in a rapidly evolving financial landscape. The push towards customer-centric services and the demand for seamless digital experiences are also significant factors contributing to this growth.

How does SaaS improve operational efficiency for banks?

SaaS improves operational efficiency for banks by providing automated workflows, real-time data analytics, and cloud-based collaboration tools. These features enable banks to streamline their processes, reduce manual errors, and enhance decision-making capabilities. For example, SaaS platforms can automate loan processing, fraud detection, and customer onboarding, significantly reducing the time and resources required. Moreover, the centralized nature of SaaS allows for better data management and accessibility, ensuring that employees can work more efficiently across different departments.

What are the security concerns associated with SaaS in banking?

While SaaS offers numerous benefits, it also raises security concerns for banks, particularly regarding data privacy and cybersecurity. Banks handle sensitive customer information, and any breach could have severe consequences. To mitigate these risks, SaaS providers implement advanced security measures such as encryption, multi-factor authentication, and regular security audits. Additionally, banks must ensure that their SaaS providers comply with industry regulations like GDPR and PCI DSS to maintain data integrity and protect against potential threats.

How is SaaS shaping the future of banking services?

SaaS is shaping the future of banking services by enabling innovation and personalization. With SaaS, banks can quickly deploy new services and features, such as mobile banking apps, AI-driven financial advice, and blockchain-based transactions. This agility allows banks to stay competitive in a market that demands constant innovation. Furthermore, SaaS platforms facilitate the collection and analysis of customer data, enabling banks to offer personalized financial products and services tailored to individual needs. As a result, SaaS is not only transforming how banks operate but also enhancing the overall customer experience.

Deja una respuesta

Entradas Relacionadas